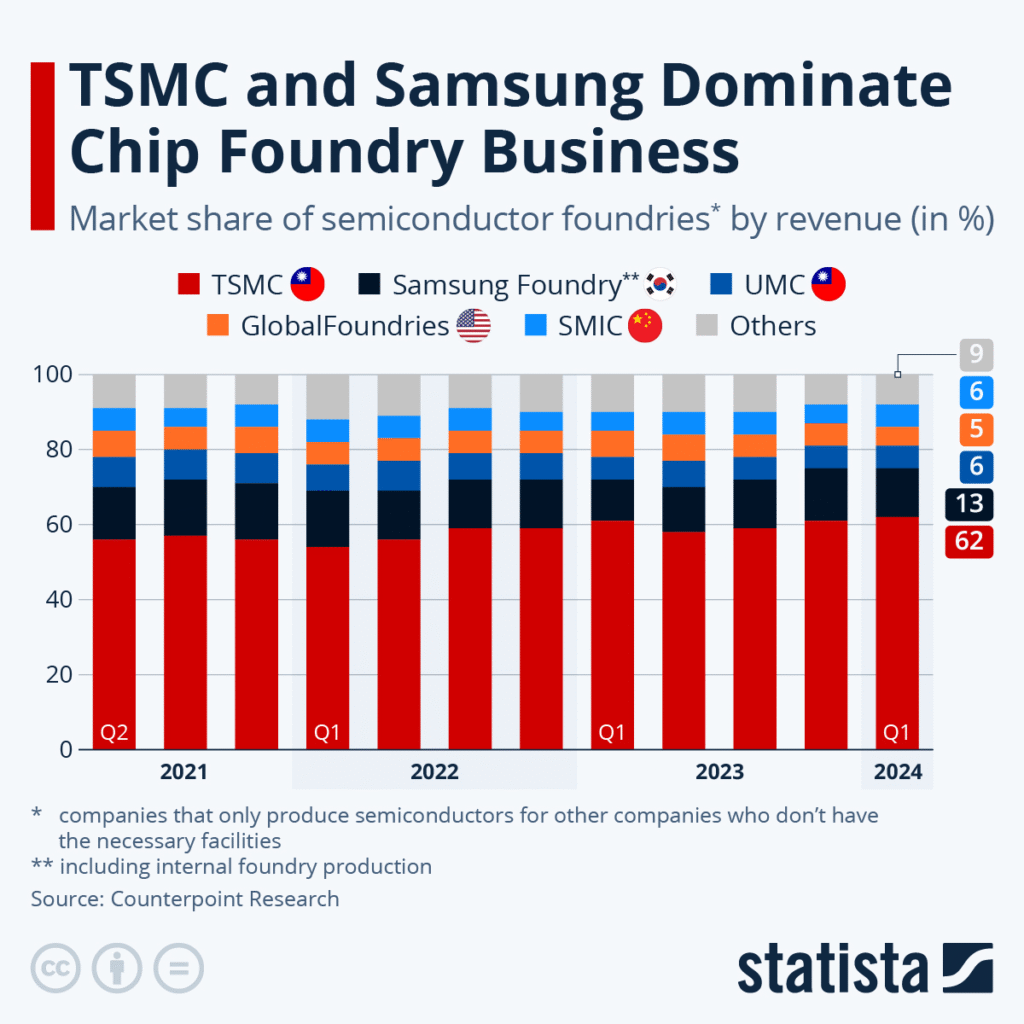

The global chip race is on — countries are racing to secure chip supply, build fabs, and own crucial parts of the semiconductor value chain. The global semiconductor market was roughly $627–700 billion in 2024–25 and is projected to grow toward $1 trillion by 2030, driven by AI, cloud, telecom and automotive demand. Taiwan, South Korea, the U.S. and China still dominate advanced nodes and volume manufacturing today.

The global semiconductor heavyweights — think TSMC, Intel, Samsung, and others — are charging ahead with bleeding-edge process nodes, massive fab investments, and advanced packaging innovations. For example, TSMC has unveiled its roadmap toward 1.6nm “A16” process technology (with features like backside power rail) expected around late 2026. They’re also working on 2nm nodes (N2, N2P) in 2025–26, improving yield, reducing defect density compared to prior nodes and gearing up for AI/data-centre demands. Meanwhile, Intel is making big plays in Europe: its Fab 34 in Leixlip, Ireland has started high-volume production of its “Intel 4” tech using EUV lithography. Intel is also planning new fabs in Magdeburg (Germany) worth over €30 billion for next-gen (Angstrom-era) nodes under its IDM 2.0 strategy. Collectively, these firms are aggressively investing in cutting-edge nodes (sub-3nm / ~2nm class), new fab locations (US, EU, East Asia), advanced packaging (3D, chiplets), and pushing process efficiencies — all to stay ahead in the global chip race, especially as demand surges for AI, HPC, mobile, automotive, etc.

Where is India in this race? The short answer is, it’s still a newcomer. India has not been a major player in wafer fabrication (fabs) for advanced logic or memory. Instead, it has traditionally been strong in design (chip design services), electronics manufacturing, and software — but not in full-scale semiconductor fabrication.

It’s changing though. India has been ambitious lately. The central plank is the India Semiconductor Mission (ISM) backed with roughly ₹76,000 crore (~US$9.1 billion) in combined incentives and related PLI schemes and state-level packages to attract fabs, ATMP (assembly, testing, marking and packaging) and OSAT (outsourced semiconductor assembly and test) units. There are additional schemes like SPECS (electronics components) and state incentives (Gujarat, Telangana, Karnataka, etc.).

With these schemes and incentives there has been some concrete movements. Approvals and projects have multiplied since 2022. Examples include Tata’s wafer fab approvals, Micron’s ATMP/OSAT in Gujarat, and the high-profile Vedanta–Foxconn Dholera announcement (a large fab plan announced earlier, with some rework since). Several states have created semiconductor policies; private players (Tata, Vedanta, Micron, ISMC, HCL-Foxconn joint efforts) and global OEMs are signing MOUs or getting approvals. Still, many projects are at different stages — approvals, land allocation, or early construction.

India’s strategy has been pragmatic: start where it can scale fastest. Main focus areas are:

- Assembly, Test, Marking & Packaging (ATMP / OSAT) — quicker to set up and labour-intensive.

- Mature-node wafer fabs (≥28nm to >14nm) and specialized fabs (e.g., SiC for power electronics).

- Design, IP, and electronic components via PLI and component schemes to build an ecosystem.

But why has India lagged so far ? Several reasons: fabs require massive capital (multi-$bn), decades of ecosystem building, ultra-clean infrastructure, and skilled wafer-fab workforce. Countries that lead invested for decades, developed clusters (vendors, equipment makers, materials), and supported supply chains. India is strong in talent and software, but lacked the concentrated supply-chain ecosystem and initial capital incentives until recently. Geopolitics and complexity of the semiconductor supply chain also slowed early movers.

India’s window is real but uphill. If current ISM-backed projects (several fabs and multiple OSAT/ATMP units) move from paper to production, India could become a regional hub for mature-node chips and packaging over the next 3–7 years, while nurturing design and specialized chips (power SiC, automotive) for export. Global demand, supply-chain diversification, and government incentives give India a structural opportunity — success will depend on execution, export linkages, and talent scaling.

If you’ve read till here, you must be wondering, why NVIDIA – the company which made lot of headlines especially after the AI boom – is not mentioned in our article. Well, NVIDIA is known for a slightly different reason than TSMC, Intel, or Samsung. We’ll cover that in a separate article. Do follow our newsletter to stay updated.