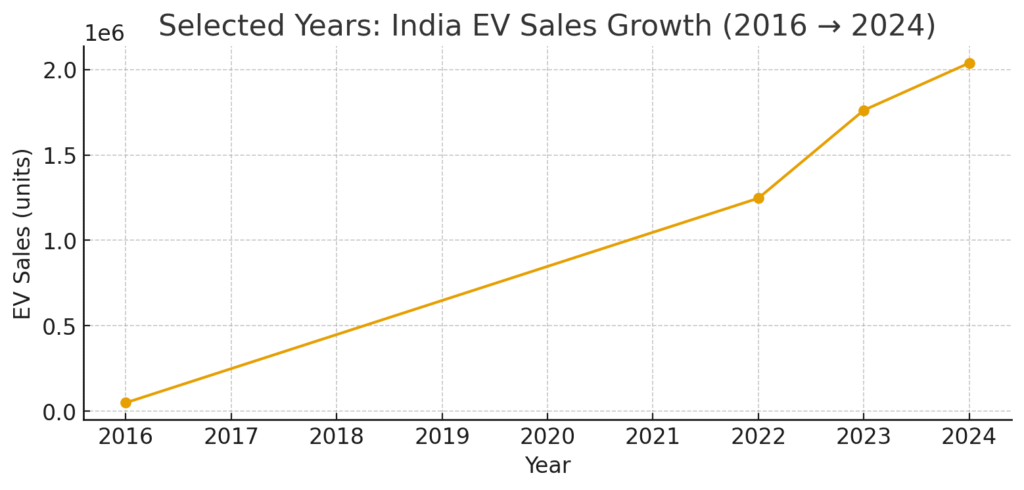

India’s electric-vehicle story is no longer “coming soon” — it’s here, noisy and fast-moving. After selling roughly 2.04 million EVs in FY 2024–25, India’s EV ecosystem is scaling across two-, three- and four-wheelers, batteries, chargers and even exports — and that matters for the global EV supply chain.

Why the leap? Two-wheelers rule the roost: high-speed e-2W accounted for the lion’s share of recent volumes (over 1.2 million units in FY24–25), while e-rickshaws and e-3W remain strong in last-mile and commercial mobility. That concentration is a uniquely Indian twist — unlike China and Europe where passenger cars dominate — and it shapes manufacturing, battery sizing and charging needs.

Here are some big picture numbers:

- EV sales in India rose from ~50,000 units in 2016 to ~2 million by 2024 — massive growth in less than a decade.

- India held ~9–11% of global EV stock/sales in 2024 — small compared to China but meaningful at scale.

- Public/semi-public chargers jumped from a few thousand (2022) to 25k–29k by end-2024/May-2025, but EV:charger ratios still need work. Government has recently announced a major boost for India’s EV charging infrastructure.

India isn’t aiming to beat China overnight; it’s carving complementary strengths. The country offers: cost-competitive manufacturing, a massive domestic two-wheeler market (useful for scaled battery & motor volume), and rising battery cell ambitions. Global carmakers and newcomers (including VinFast building a 50,000-unit/yr factory in Tamil Nadu) see India as a regional export and assembly hub. That’s a direct pipeline into Asia, Africa and the Middle East markets.

And then comes the big headline grabber: Tesla is finally making its India debut. After years of back-and-forth over import duties, the government’s new EV policy paved the way, offering duty concessions for global players investing locally. Tesla has registered a subsidiary, is scouting locations for a manufacturing facility, and is expected to begin with high-end imports before moving into more affordable, localized production. Beyond brand power, Tesla’s entry could reset consumer expectations on EV performance and accelerate India’s push to become a global EV hub.

… But, there’s a bottleneck … Batteries!

India still imports most battery cells. Policy moves like the PLI/ACC scheme targeting ~50 GWh cell capacity by 2026 aim to localize supply, but analysts expect domestic cell supply to cover only a minority (S&P projects ~13% domestic share by 2030) unless investment accelerates. In short: India can be an assembly and pack powerhouse quickly — but cell localization is the key to moving up the global value chain.

What to watch for in next 3–5 years …

- Battery cell investments and whether announced capacity becomes live capacity.

- Charger density — IEA projects major growth in public chargers; India must match EV growth to avoid bottlenecks

- Export deals & OEM localization — more foreign factories (and local champions) will decide if India becomes a meaningful exporter of affordable EVs.

Some interesting facts in Indian EV market:

- 3-wheelers already have >50% EV penetration in certain segments — a contrast to the car market.

- EV charging expansion is highly state-skewed: Karnataka, Maharashtra and UP lead deployments, leaving large rural gaps.

- Indian Railways is exploring using electric three-wheelers for last-mile delivery services from railway stations